February 06,2019 | TRIADVOCATES

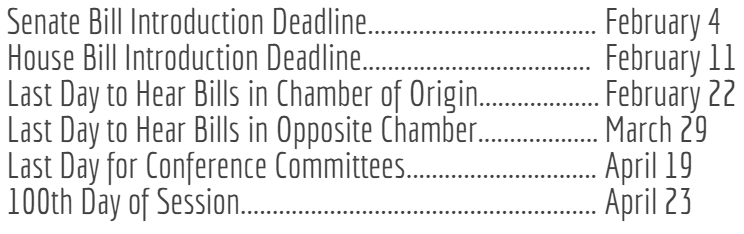

1. Close, but no cigar. Despite much fanfare over the state Legislature’s approval of the Drought Contingency Plan last Thursday, there is still work to be done, according to the feds. Less than 24 hours after Gov. Doug Ducey signed the legislation as part of a bipartisan signing ceremony, the Bureau of Reclamation responded by saying the plan wasn’t quite enough, given that several agreements between tribes, water districts, and between other states still need to be completed and signed. Arizona and California — the only holdouts among the seven Colorado River Basin states — now have until March 4 to complete the necessary steps.

2. Last week, the state House of Representatives launched the first ethics investigation of 2019. In an effort to provide proper due process surrounding recent revelations that Republican Rep. David Stringer was faced with very disturbing charges in the early 80s, House Ethics Committee Chairman Rep. T.J. Shope announced his decision to hire outside counsel, which will be tasked with conducting a thorough investigation. Meanwhile, Stringer has no plans to resign—despite the multiple calls from his colleagues and the governor. He has, however, been suspended from committee activity until the ethics investigation is completed, which could take up to six weeks.

3. Last week, House Republicans adopted several significant rule changes, including various limitations on the amount of time afforded to each member to speak on the floor in certain situations. The House also eliminated the requirement that a strike-everything amendment, or striker, be germane to the underlying bill. That rule only existed in the House, and was only implemented under former House Speaker J.D. Mesnard.

4. Every time there is a change in the federal tax code, Arizona legislators simply pass legislation that conforms the Arizona tax code to reflect it. Congress passed a major overhaul at the end of 2017 that essentially broadened what is taxable and then lowered the tax rate. If policymakers simply conformed to the federal code without lowering Arizona’s tax rate, taxpayers would pay approximately $174 million more in taxes. Not conforming also means tax confusion, as taxpayers can deduct some items on one form but not the other. There has been strong disagreement between the Legislature and Gov. Doug Ducey on how to conform. Last week, companion bills moved quickly through the House and Senate that conformed to the federal code and also reduced the individual tax rate to make the legislation revenue neutral. Lawmakers double dog dared the governor to veto this plan, thus making him responsible for tax confusion and Arizonans paying more in taxes. Less than 24 hours after passing the bill, the governor thumbed his nose at the GOP-controlled Legislature and put his big red veto stamp on the bill. Maybe a deal can be cut for future tax years, but it looks like it’s going to be a confusing time for taxpayers as they prepare their tax returns for 2018.

5. While we’re on the topic of taxes… It’s beginning to look like Prop. 126 – the voter-approved measure prohibiting the state and local governments from imposing a new or increased tax on services – will require clarification from the courts. As it stands, the language fails to clearly define what a “service” is and ambiguously addresses several scenarios, particularly one in which someone is providing goods and services at the same time, such as food service at a restaurant. Because there is no reliable definition in the tax code, experts agree that a court will have to decide who is properly interpreting Prop. 126 in the event of a lawsuit.

House Assistant Minority Leader Randall Friese to GOP lawmakers during a contentious debate on rules to put a time limit on floor speeches:

”And when you one day are in the minority, you might understand a little better.”

“Striker"

A "strike everything after the enacting clause" amendment (also referred to as a "strike-everything" amendment or simply a "striker") proposes to delete the entire text of the existing bill and substitute new language—essentially making it a completely different bill, possibly on an entirely different subject. These amendments are sometimes used to allow legislators to circumvent the deadlines on introduction of new legislation, deal with an issue that arises after the deadline or revive a bill that has previously been defeated.

“The bill is dead—for now. It could always come back as a striker.”

“The stakeholders came to an agreement and no longer need to run legislation, but the sponsor plans to use the bill as a vehicle for a striker.”